The Student Debt Trap: A Battle Plan for Your Financial Freedom

Let’s stop calling it a “crisis.” That’s a soft, polite word for a national mugging. A crisis is a storm that passes. This isn’t weather; it’s a meticulously engineered machine built for one purpose: to bleed your future dry, one monthly payment at a time. This isn’t a problem you need to solve; it’s a war you were born into, and you are in the goddamn trenches.

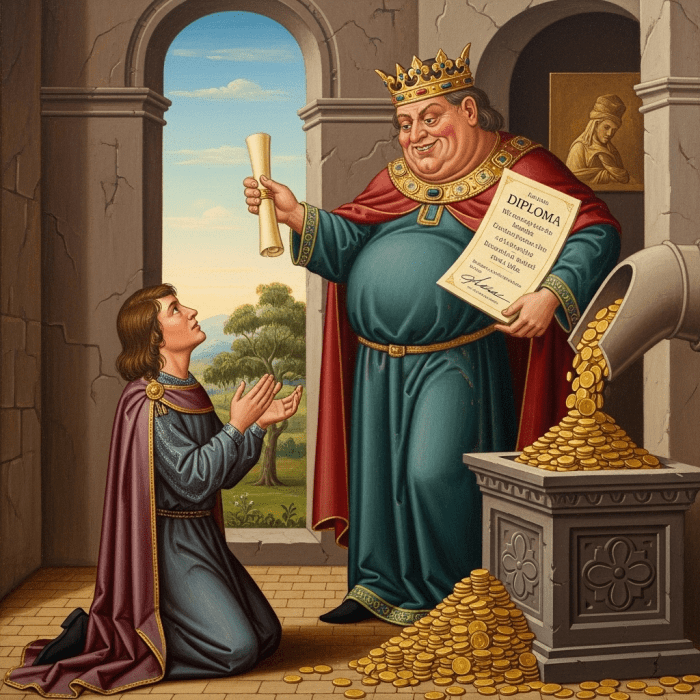

They sold you a golden ticket to a better life and neglected to mention the ticket was printed on an invoice for your own soul. The lie you swallowed—the one about a degree being the only path to prosperity—is the foundation of a trillion-dollar heist.

It’s time we stopped playing the victim and started fighting back. Welcome to the resistance.

Battle Brief: The State of the War

Before we arm you, you need to see the battlefield for what it is. Here is the cold, hard intelligence, stripped of all bureaucratic bullshit.

| Intelligence Metric | Current Battlefield Assessment |

| Total Debt Load | ~$1.8 Trillion USD |

| Active Combatants | Over 42.5 Million Americans |

| The Primary Enemies | Predatory Lenders, Negligent Servicers, & A Complicit Government |

| Psychological Warfare | Widespread anxiety, depression, and crippled life milestones |

| The Battle Plan | Total Forgiveness, Free Public College, an Empowered CFPB, & Simplified Repayment. |

The Predatory Machine: How They Built the Trap

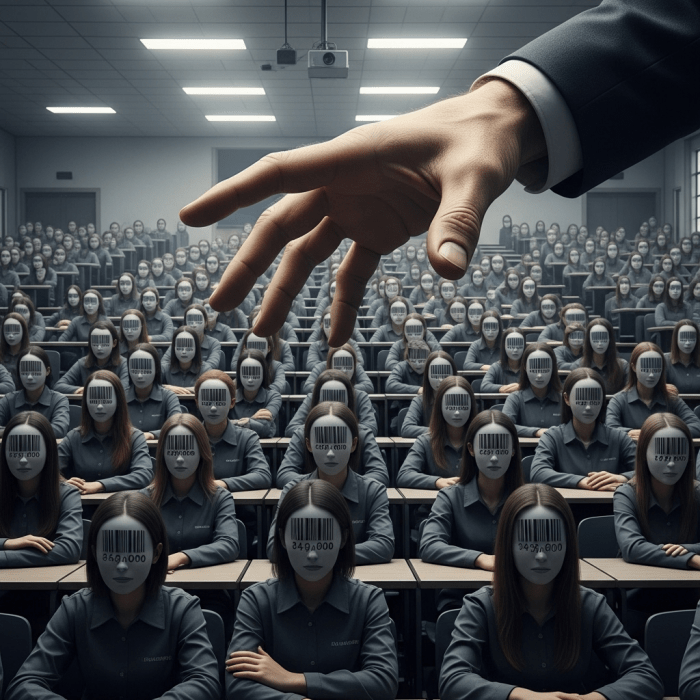

The enemy isn’t a faceless economic force. It’s a hydra, a multi-headed beast of financial ghouls who have perfected the art of legalized theft, and they feast on the ambition of the young.

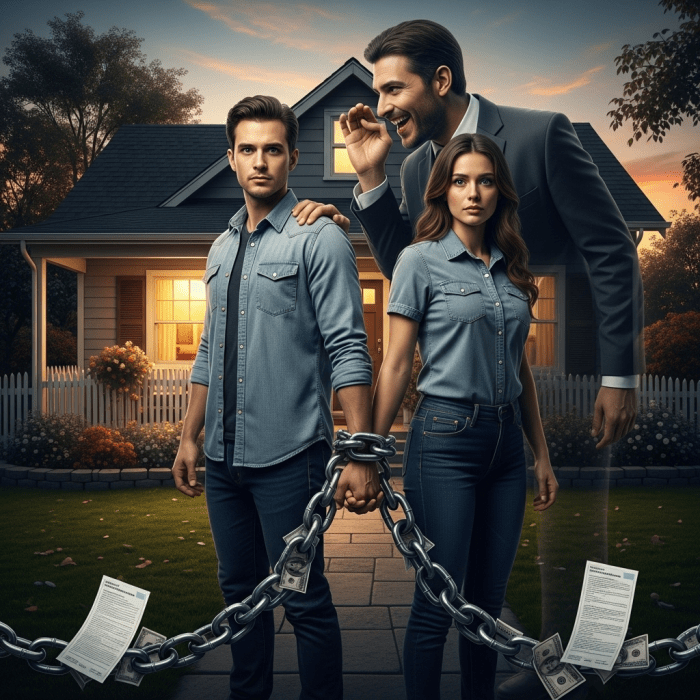

Lenders: Architects of Your Failure

The first shot in this war is fired the moment you sign the loan documents. They bake astronomical interest rates and incomprehensible fees into the fine print of a contract you’re too young and hopeful to understand. They don’t make their money when you diligently pay off your debt. They make a killing when you are shackled to it for decades, paying multiples of what you originally borrowed. They’ve weaponized the American Dream and turned it into a financial prison.

IMAGE: A young female graduate forces a smile through tears, while a single tear tracing down her cheek contains the text ‘6.8%,’ representing the interest rate staining her moment of triumph.

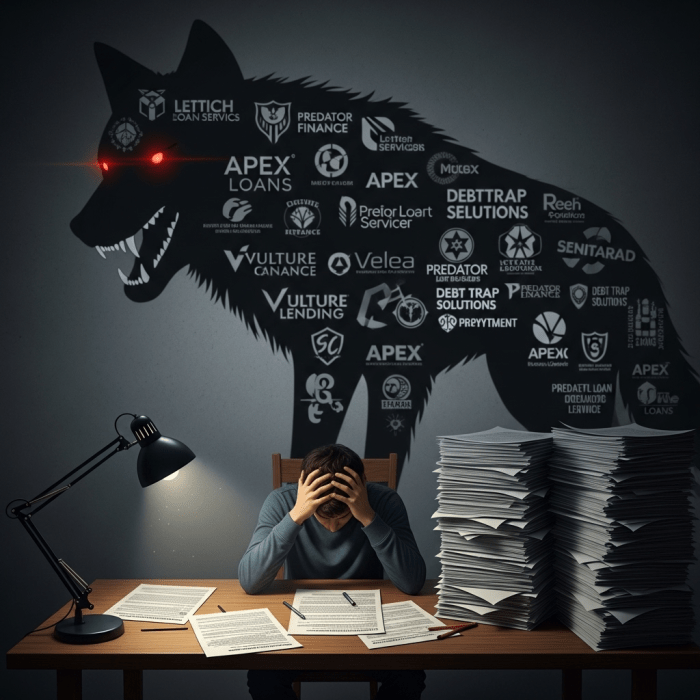

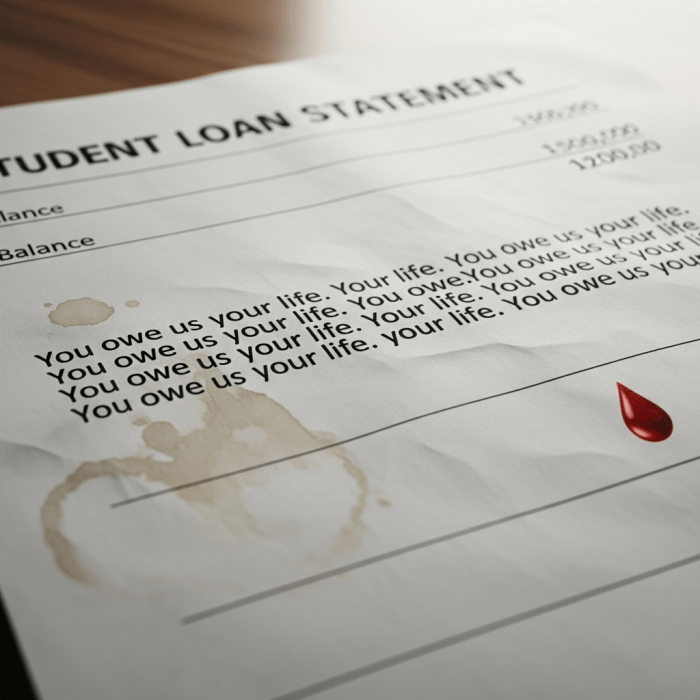

Servicers: The Bureaucratic Enforcers

Once you’re trapped, you’re handed over to the loan servicers. Think of them as the prison guards. Their job description says they “manage” your loans; their real mission is to mismanage your life into a deeper hole of debt through systematic incompetence and malicious misdirection. This isn’t speculation; it’s documented fact. The Consumer Financial Protection Bureau (CFPB) has repeatedly taken action against these vultures for their predatory practices, but for every one they slap on the wrist, a dozen more operate in the shadows.

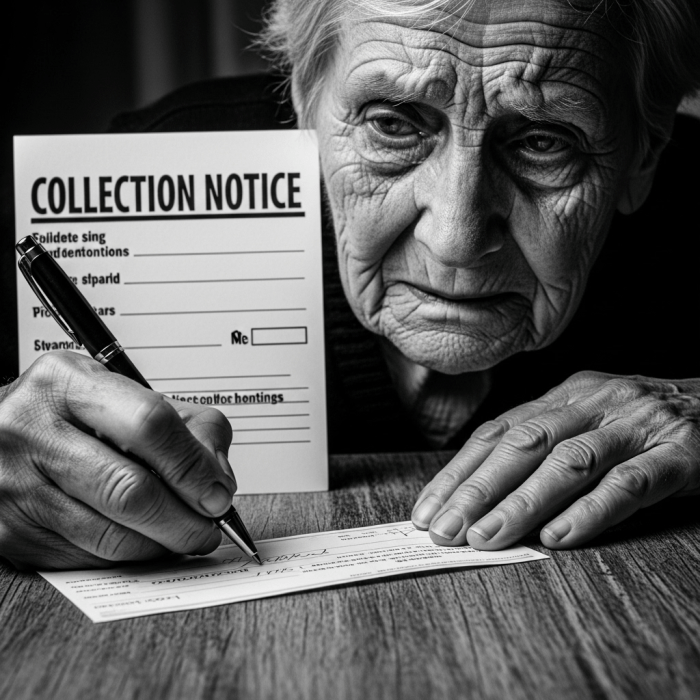

Government Complicity: The Silent Partners in the Heist

Do not for a second believe the government is an innocent bystander. They are the architects of the prison itself. For decades, they have collaborated to create a labyrinth of repayment programs so complex that they are impossible to navigate. They pass laws that make student debt nearly impossible to discharge in bankruptcy, giving it a horrifying “super-debt” status. This isn’t a bug in the system; it’s a core feature of a broken political machine.

The Psychological Siege: How Debt Systematically Destroys Lives

This war is not fought on a balance sheet. It is fought in your mind, at 3 a.m., when you wake up with a pounding heart, wondering how you’ll ever get out from under it.

Your Debt is a Mental Prison

Student debt is a psychological poison. It is a constant, nagging whisper that tells you that you are not free. Studies consistently show that the majority of borrowers experience significant anxiety, stress, and depression directly because of their educational debt. It dictates your career choices, it delays life itself, and it is a constant, grinding weight on your spirit.

This isn’t just about money. It is the theft of your ambition. It is the systematic replacement of your dreams with a gnawing, ever-present fear. It is a deep, soul-level exhaustion mixed with a white-hot, impotent rage.

The Homeownership Heist & The Social Rot

The damage goes far beyond the individual. It’s an internal rot that weakens the very fabric of our society. Data from the Federal Reserve has explicitly shown that rising student loan debt directly suppresses homeownership rates for young adults. When an entire generation is blocked from building equity, from planting roots in a community, we all lose.

A History of Betrayal: How America Went From Investment to Exploitation

This wasn’t always the reality. To understand how to fight, you must understand how you were betrayed.

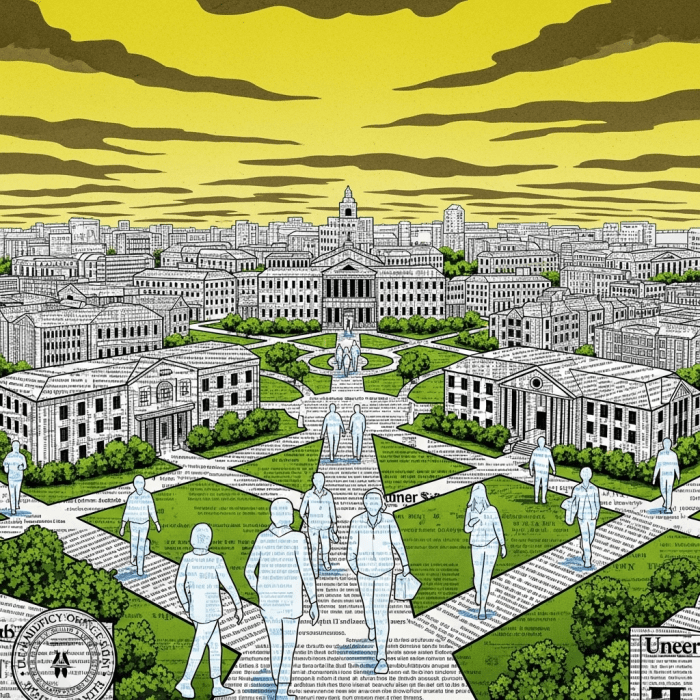

The Post-WWII Promise

In the decades following World War II, a college education was seen as a public good, an investment in the nation’s future. Fueled by policies like the GI Bill and significant state funding, college was broadly affordable. The philosophy was simple: an educated populace is a strong populace. The country invested in its people.

The Great Erosion

Beginning in the late 1970s and accelerating through the following decades, that philosophy was abandoned. Public funding for higher education was slashed, and the responsibility for that cost was systematically shoveled onto the backs of 18-year-olds and their families. They took the money that used to build universities and used it to fund tax cuts for the ultra-wealthy. They privatized the profits and socialized the risk.

Your First Strike: Immediate Counter-Offensive Measures

A revolution is the goal, but a battle starts with the first shot. Before we storm their castles, you must fortify your own position. Here are the immediate, tactical steps you can take RIGHT FUCKING NOW.

| Counter-Offensive Step | Your Actionable Orders |

| 1. Know Thy Enemy | Check your EXACT loan status. Go to the official StudentAid.gov website. This is your truth. Don’t trust your servicer’s numbers or their lies. Get your own intelligence. |

| 2. Report Their Bullshit | File a formal complaint with the CFPB. Every complaint is a bullet. It creates a paper trail, forces them to respond, and gives our allies in government ammunition. It’s a powerful act of defiance. Go to: consumerfinance.gov/complaint. |

| 3. Minimize the Bleeding | Understand Income-Driven Repayment (IDR). These plans are flawed tools, but they can be a temporary survival tactic. Research them on StudentAid.gov and see if you qualify. It’s not a solution, but it’s a tourniquet. |

| 4. Find Your Comrades | You are not alone in this trench. Find free, non-profit debt counseling services through organizations like the National Foundation for Credit Counseling (NFCC). Connect with advocacy groups. There is strength and sanity in numbers. |

The Manifesto for Revolution: A 4-Point Battle Plan

Survival is not enough. We are not fighting for better cage conditions. We are fighting for liberation. The time for quiet anger is over. Here is the manifesto. These are the demands.

1. Demand Total Forgiveness: Burn the Ledgers

We must wipe the slate clean. This means full, retroactive forgiveness of all federal student loan debt. This is not a “handout.” It is an economic defibrillator to shock a generation back to life.

2. Fix the Source: Make Public College Affordable or Free

Forgiveness without reform is just a temporary cease-fire. Public colleges, universities, and trade schools must be made affordable—or tuition-free—as they were for previous generations.

3. Unleash the Watchdog: Empower the CFPB

The Consumer Financial Protection Bureau needs to be transformed from a watchdog with a loud bark into a dire wolf with a taste for predatory blood. This means more funding, a stronger mandate, and the teeth to not just fine, but systematically dismantle predatory companies.

4. Standardize and Simplify: End the Shell Game

The labyrinth of complicated repayment plans must be abolished and replaced with a single, simple, universal plan designed for user success, not bureaucratic obfuscation. No more lies.

Conclusion: Light the Fucking Resistance

The truth is clear. The systems are rigged, the history is a lesson in betrayal, and the human cost is immeasurable. They want you to feel isolated. They want you to feel ashamed. That is their greatest weapon.

Your debt is not your shame. It is their crime. Your anger is not a flaw; it is a righteous and necessary fuel. But anger without action is just noise. This is your call to arms.

Your fight starts now. Step 1: Share this manifesto. Step 2: Execute your ‘First Strike.’ Step 3: Contact your representatives and demand they support the full 4-Point Plan.

Stop fighting for crumbs. It’s time to smash the whole goddamn table.

Frequently Asked Questions (FAQ)

1. Is total student loan forgiveness realistic?

It’s a question of political will, not economic possibility. The U.S. government has authorized trillions in bailouts for banks. Forgiving student debt is a direct investment in its people with a far greater economic return.

2. What’s the difference between Federal and Private student loans?

Federal loans are issued by the government and have borrower protections. Private loans are from banks and have almost none. Our fight is primarily against the federal system, which comprises ~93% of all student debt.

3. I’m already in default. What should I do?

Don’t panic. You have options. Visit StudentAid.gov or contact a non-profit credit counselor to learn about programs like “Fresh Start” that can get you back on track.

4. Will student loan forgiveness cause inflation?

This is a scare tactic. Most economists agree the inflationary impact would be small. The long-term economic boost from freeing up an entire generation of consumers would be substantial.

5. Why not just focus on lowering interest rates?

Lowering interest rates is treating a fatal wound with a band-aid. We need to stop the bleeding (0% interest), but we also need to cure the disease (mass forgiveness and tuition reform).

6. How does the student debt crisis affect everyone, even those without debt?

It acts as a massive brake on the entire economy. A generation unable to buy homes, start businesses, or save for retirement creates a weaker, less dynamic economy for everyone.